Where more homes are selling at a discount

Despite higher interest rates, the share of homes being sold below the asking price has fallen over 2023, signalling a strengthening of market conditions.

Where more homes are selling at a discount

Despite higher interest rates, the share of homes being sold below the asking price has fallen over 2023, signalling a strengthening of market conditions.

But PropTrack data shows the proportion of vendor discounting – the differences between asking and sold prices for homes – varies widely between capital cities.

The data suggests vendor discounting is currently most common in Hobart and Brisbane, and least common in Adelaide.

So, what does this tell us?

Analysis of the data shows that overall, vendor discounting is more common in areas with recent price growth and suggests market conditions remain stronger than before the pandemic.

The rate of vendor discounts has decreased in 2023.

While not all homes listed for sale include an asking price, those that do can reveal interesting information about the balance of negotiating power and the expectations of buyers and sellers.

The pandemic saw a rapid decrease in the proportion of homes sold below asking prices as housing demand boomed and prices increased rapidly.

But 2022 saw a strong increase in the share of homes sold at a discount to the asking price, which followed interest rates increasing at their fastest rate on record and persistent home price falls.

That trend has reversed this year as market conditions – and prices – have improved.

The share of homes being sold below the asking price has fallen and now sits markedly below the level seen before the pandemic.

The typical discount has also decreased

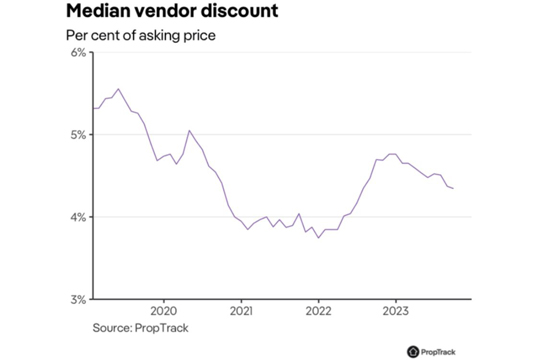

As vendor discounts have become less common this year, the typical size of the discounts received by buyers has also shrunk.

Before the pandemic, the median discount (among those properties sold below the asking price) was around 5% of the asking price.

That reduced to around 4% at the peak of the pandemic, but noticeably increased in 2022 as interest rates increased and prices fell.

The current rate of typical vendor discounting now sits somewhere between these two figures.

Discounting highlights changing conditions across markets

Vendor discounting also gives an idea of relative market conditions.

Adelaide has recorded the lowest rate of vendor discounting for a while, and was the one region to see only a small increase in discounting in 2022. This highlights how strong market conditions have been across Adelaide – one of the few regions to continue to see price growth over the past two years.

By contrast, Hobart went into the pandemic with the lowest rate of vendor discounting, having experienced strong market conditions for several years before the pandemic.

But after recording a sharp increases over 2022 and 2023, Hobart now has the highest rate of vendor discounting among the major capitals.

Comparing across time, almost all markets are recording vendor discount rates significantly below pre-pandemic levels, which points to continued robust general market conditions across the country.

Rate of discounting often follows recent price results

Vendor discounting tends to follow recent price growth outcomes. Comparing the share of listings that sell above asking prices (the opposite of vendor discounting) with recent price growth shows a close relationship.

This is clear when comparing both in the largest markets of Sydney and Melbourne.

But vendor discounting tends to reflect price growth recorded a few months ago, rather than signalling the direction of future price growth.

It makes sense that when prices are rising, there is more competition for properties, and more sell above their asking prices.

Strong market conditions across the country

Vendor discounting provides an indicator of market strength, and is one of the many measures used to gauge conditions across the country.

The rate and level of discounts currently shows that the property market conditions remain strong relative to prior to the pandemic across the country.

This article was originally published on realestate.com.au as Where more homes are selling at a discount.

You might also like:

The cost-of-living crisis hasn’t stopped Australians from dreaming about living in the most luxurious and expensive homes on the market

You might also like:

Property experts have handpicked the best coastal suburbs in Australia for 2024, offering a mix of good growth prospects, amenities and infrastructure.

You might also like: